- Individuals & Families

- Businesses

- Agents & Brokers

- Embedded Insurance

Chubb ranked #1 for Customer Satisfaction with the Home Insurance Claims Experience

Chubb ranked #1 for Customer Satisfaction with the Home Insurance Claims Experience

Chubb ranked #1 for Customer Satisfaction with the Home Insurance Claims Experience

Chubb ranked #1 for Customer Satisfaction with the Home Insurance Claims Experience

Because pets are family, Chubb now offers pet insurance with top-rated coverage from Healthy Paws.

Chubb offers the insurance protection you need for travel’s many “what ifs”.

Chubb protects small businesses at every stage – from newly formed start-ups to long-time anchors of the community.

Stay ahead of cyber threats with our free Cyber Claims Landscape Report.

Learn more about our dedicated learning paths, Online Learning Center, and more.

Many digital-savvy consumers look for it as a core or add-on option.

Many digital-savvy consumers look for it as a core or add-on option.

Many digital-savvy consumers look for it as a core or add-on option.

Chubb’s in-house technology makes it easy to integrate what we do into your customer experience.

-

About

-

Claims

-

Login & Pay Bill

For Agents & BrokersFor Travel Advisors

-

Back

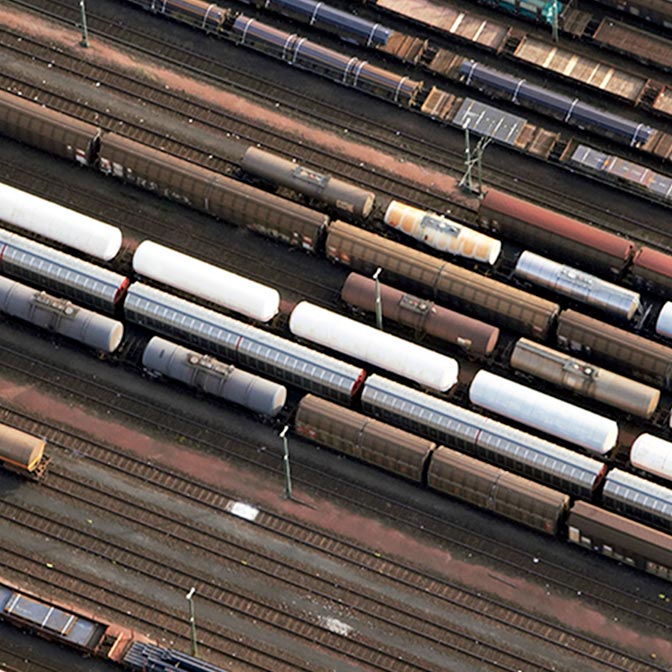

Railroad

Railroad Insurance Products

Railroad operations and contractors have unique liability needs. We offer coverage designed specifically for damages resulting from covered perils.

A contractors’ general liability policy is not sufficient to address the unique set of risks that construction projects built alongside or over a railroad tend to carry. In fact, CGL policies typically exclude the contractor’s work within 50 feet of a railroad. Therefore, railroad operators will require the contractor(s) to provide a Railroad Protective Policy in addition to all other insurance requirements. The coverage is project specific and covers bodily injury and property damage arising from acts or omissions relating to job-site operations being performed by the designated contractor.

Insights and expertise