Welcome to Chubb Industry Practices

We believe business insurance should just connect.

That’s why we have industry specialists in underwriting, risk engineering and claims who can see the big picture. They understand the unique industry risks our clients face, and can connect different types of cover and services together to meet client needs for their operations wherever they are around the world.

Why?

We think your insurance should address your specific industry's needs. And when insurance joins up (like it should) there's less chance of policy gaps and overlaps.

At Chubb Industry Practices, our specialist products and services are designed with client needs in mind, and our in-depth industry expertise enables us to anticipate new risks and adapt our solutions. We get under the skin of industry issues, which enables us to provide the best solutions for our clients.

Specialising in Life Sciences for 25+ years, we offer specialist products, supported by underwriters, risk engineers and claims handlers who are industry specialists. From product liability and clinical trials to professional indemnity, and property insurance to cyber and marine, we have it covered. We can support from the early R&D phase through to complex multinational.

We've been specialising in technology since the age of brick phones. Our Technology Industry Practice has tailor-made products and services to support Technology companies from software developers to data centres. In addition to Tech E&O and cyber we also cover liability, property, and much more. All backed by specialised underwriters, risk engineers and claims handlers.

Our Real Estate Industry Practice is backed by an enhanced proposition which includes specialist Real Estate underwriters, dedicated account engineers and Real Estate claims specialists, all underpinned by Chubb's global presence and local knowledge.

Our bespoke media expertise safeguards your business, your people, and your vision for the future. Whether you are a consultant operating in advertising, graphic designer, or publisher, our product is designed with your needs in mind. From Media liability and cyber, and to property and casualty we have you covered.

Because the biggest challenges need to be met by broad and deep expertise, we draw on our extensive technical capabilities in underwriting, risk engineering and claims to provide tailored solutions for businesses making climate change progress around the world.

As Climate Tech businesses innovate and build new technologies for the low carbon future, they face unique risks due to both the unprecedented nature of their operations and an evolving regulatory environment.

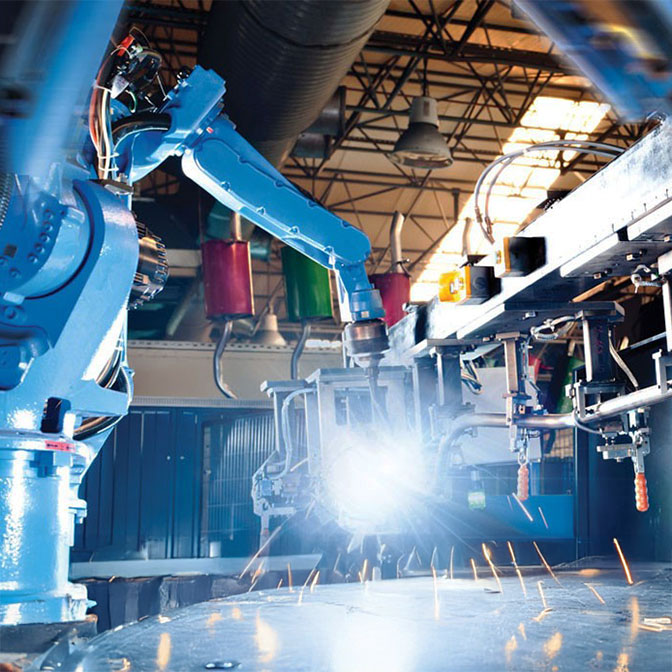

Our Construction Industry Practice brings everything together in one place for a wide range of construction segments, from mid-market contractors to the largest one-off projects to offer bespoke and package insurance products to meet the specific needs of our construction clients

The Renewable Energy and Alternative Fuel sectors are rapidly evolving and present significant risks. Companies rely on complex infrastructure in hazardous environments and must prioritize safety and business continuity.

Insights & Resources