Throughout history, life science companies have always been at the cutting edge of innovation. Culturally, this has not changed. Life science businesses are increasingly looking across industries and sectors to synthesise the leading technological advancements to improve their products and services. In this article we will explore some of these new trends and their risk profiles.

New technology

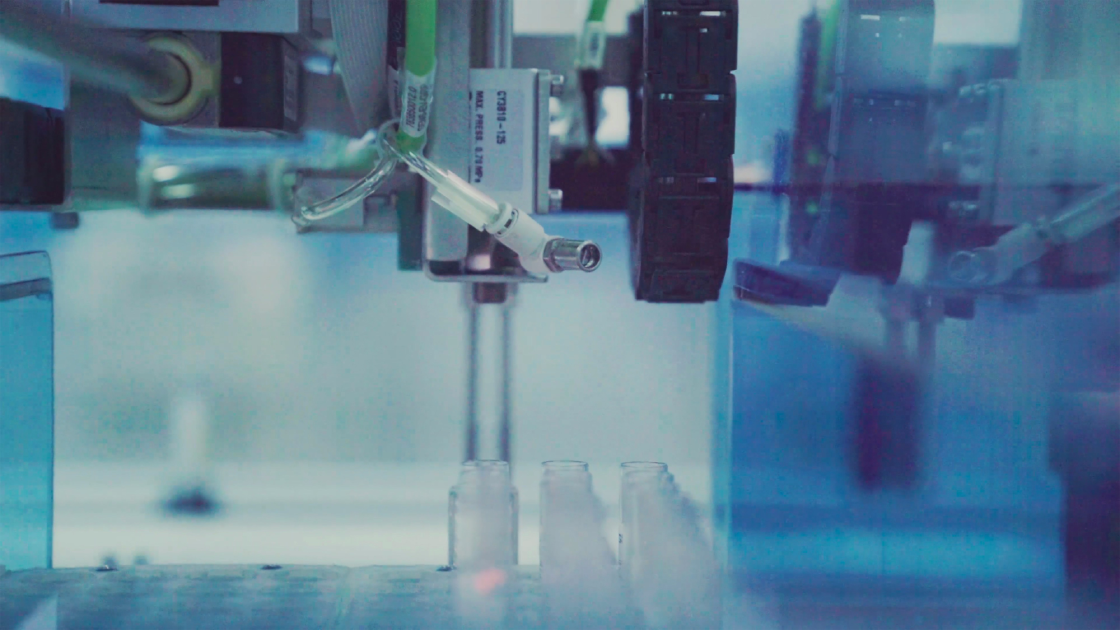

Robotics and automation. Advanced robotic systems have enabled some surgeons to operate on patients from a remote room or even a different continent, allowing patients to be treated by specialists who are not based in their region or country. Currently, there are startups using robotics to manufacture life science products in space, such as automating pharmaceutical or medical device productioni. These companies are using the advantageous manufacturing conditions in orbit to test if they yield better results than can be achieved on Earth. While added standardisation and minimising human error is a feature, added complexity to the machine can come with its own unique challenges.

Remote trials and wearables. Leveraging telemedicine and wearable devices to conduct remote clinical trials is growing in popularity. Telemedicine allows for virtual consultations between patients and healthcare providers, eliminating the need for physical visits. Wearable devices, such as smartwatches and fitness trackers, can continuously monitor vital signs and collect data, providing real-time insights into patient health. These technological advancements facilitate more efficient and inclusive clinical trials, and expand the participant pool for clinical trials companies.

Big data analysis. The abundance of data in the life sciences has led to a surge in the adoption of big data analytics. Companies are using advanced analytics techniques to extract valuable insights from vast datasets generated from various sources, including clinical trials and electronic health records. By analysing this data, life science companies can identify new drug targets, optimise clinical trial designs, and develop more personalised treatments. Initiatives like the European Open Science Cloud (EOSC) are facilitating the collaborative use of data resources, fostering international collaboration and driving scientific progress.

Digitisation and connectivity. From electronic health records and remote patient monitoring to cloud-based research platforms and connectivity of devices and systems using the Internet of Things, digital technologies are reshaping the way life science companies operate. This shift has enabled more efficient data management, real-time accessibility of data, accelerated research and development, and improved patient outcomes.

Managing the change

Culture shift. While the transition to a technologically driven culture is essential for success in the modern life sciences landscape, it can present significant challenges. Employees who are accustomed to traditional processes may be reluctant to embrace new technologies and ways of working. Additionally, the shift towards a more data-driven and digital approach may require new skills and mindsets, which can be challenging for employees who are used to a more hands-on and intuitive way of working. To address these challenges, companies may want to invest in effective communication and change management strategies, providing employees with the necessary training and support to help them adapt to the new technological environment.

Regulatory compliance and liability. As new technologies emerge, companies must ensure compliance with evolving regulatory frameworks and address potential liability issues. A notable example is which may apply additional regulatory scrutiny to life science companies’ products. This and other regulation may require investing in legal and compliance expertise, conducting thorough risk assessments, and developing robust data privacy and security protocols.

Cybersecurity. Increased use of technology can lead to cyber vulnerabilities. Protecting sensitive patient data, intellectual property, and critical infrastructure is essential. Life sciences companies should invest in robust cybersecurity measures, including network security, data encryption, access controls and employee training on cybersecurity best practices. Our article on cybersecurity tips for life science companies details the steps businesses can take to help protect themselves.

Business interruption. Using advanced technologies may require businesses to purchase expensive equipment or develop proprietary tools in-house. Should parts need maintenance or repair, it may take longer than expected to restore the equipment to full working order because of the availability of specialist tools. Because of this, life science companies should consider their business interruption periods and explore purchasing and storing spare parts.

Conclusion

As technology becomes more accessible to all segments of life science businesses, they, along with their insurance brokers and insurers should work together to understand the impact of technology across the business and the associated risk profiles. Doing so will enable risk managers and their insurance partners to tailor coverage to their specific requirements. It’s also important for life science businesses to consider partnering with an insurer who is constantly horizon scanning to understand the latest technological developments in the field and their risk profiles.

Specialising in Life Sciences for over 25 years, Chubb offers specialist products, supported by underwriters, risk engineers and claims handlers who are industry specialists. From product liability and clinical trials to professional indemnity, and property insurance to cyber and marine, we have it covered. We can support from the early R&D phase through to complex multinational. Contact us today to learn how you can partner with us to utilise our expertise and experience with the life sciences.

i ‘The next generation of drugs could be made in space. Here’s why.’, BBC Science Focus, 23 March 2024 and ‘Robotic Surgery in Space’, NASA, 7 June 2024

Insights and expertise

All content in this material is for general information purposes only. It does not constitute personal advice or a recommendation to any individual or business of any product or service. Please refer to the policy documentation issued for full terms and conditions of coverage.

Chubb European Group SE (CEG) is an undertaking governed by the provisions of the French insurance code with registration number 450 327 374 RCS Nanterre. Registered office: La Tour Carpe Diem, 31 Place des Corolles, Esplanade Nord, 92400 Courbevoie, France. CEG has fully paid share capital of €896,176,662. UK business address: 40 Leadenhall Street, London, EC3A 2BJ. Authorised and supervised by the French Prudential Supervision and Resolution Authority (4, Place de Budapest, CS 92459, 75436 PARIS CEDEX 09) and authorised and subject to limited regulation by the Financial Conduct Authority. Details about the extent of our regulation by the Financial Conduct Authority are available from us on request.