- Businesses

- Individuals & Families

- Partnerships

- Brokers

Chubb Climate+ spans major industries, with a goal of enabling climate change progress in a meaningful way.

All Chubb policyholders are eligible for cyber services. Get the most value from your Chubb policy and schedule a consultation today.

In a complex world, Chubb’s support for multinationals and their brokers when choosing the right cover has never been more valuable.

As one of the world's largest providers of jewellery and fine art insurance, you can count on our unparalleled service and expertise, offering some of the broadest protection available.

As pioneers of using in-house appraisers to help clients establish the value of their property, and mitigate the risk of loss, our appraisal service is a key reason why owners of fine homes and high value possessions around the world choose Chubb

Build your business by providing the protection your customers need – it’s insurance for the new possible.

The seamless, secure, and scalable engine behind new possibilities for your company and customers.

-

About

About UsWho We AreFinancial & Regulation

- Claims

-

FCA Regulation

-

Contact

Chubb CareersComplaints

-

BackSuggested Searches

Fleet

Who we insure

Chubb insures large fleets operating in the following sectors:

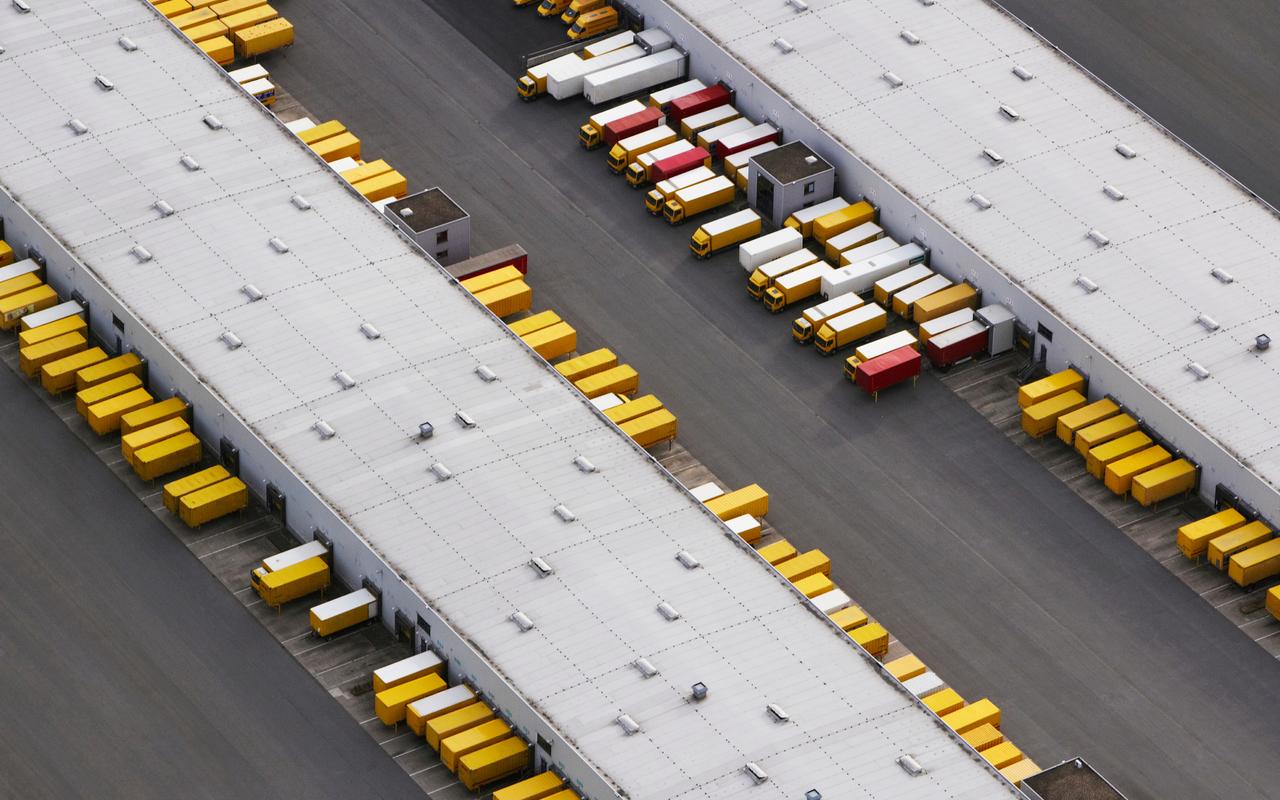

- Logistics

- Construction

- Contractors

- Infrastructure and Utilities

- Heavy vehicle transport

- Refrigerated vehicles

- Tippers, tankers and recovery vehicles

- Trailers

- Bus and coach operators

- Hire and Reward

- Taxis

- Couriers

- Self-drive-hire

- Private Cars

- Small Commercial

- Tool of trade

Coverage

Risk engineering for logistics

At Chubb, our risk engineers understand that managing risk in Logistics is a uniquely complex interaction of high value assets, tight financial margins, rapidly developing technology, overlapping regulatory requirements, and multi-dimensional human factors.

Using our own bespoke assessment tools to help you, our in-house risk engineers will build a partnership with you to understand your approach, evaluate the solutions you have chosen and support your pursuit of continual improvement.

Potential areas of focus:

- Driver selection, profiling, training, and development

- Technology and telematics

- Electric vehicles/alternative fuels

- Delivery point, warehouse and depot health and safety

Chubb's claims service is designed to provide logistics companies and other large fleet operators with prompt, efficient, and personalised support during critical moments.

A robust claims service is essential, as it not only alleviates the stress of managing unexpected incidents but also ensures minimal disruption to operations. Fleet downtime can lead to significant financial losses and customer dissatisfaction. Our dedicated claims professionals and specialist partners understand the unique challenges faced by operators of large fleets, offering tailored solutions that expedite the claims process and facilitate quick recovery. This proactive approach not only enhances operational continuity but also reinforces trust and confidence in insurance partnerships, allowing companies to focus on their core operations without the burden of navigating complex claims procedures.

FAQs

Our policy provides affirmative cover for legal liability for bodily injury and property damage caused by the release of pollutants. Additionally, it provides indemnity for clean-up costs and regulatory action arising from pollution or biodiversity damage caused by the insured.

Our approach to Logistics Claims

The Chubb Claims Philosophy is ‘Setting a Standard, delivering beyond.”

At Chubb we understand that the handling of every claim is the most critical test of our service, our support and our reputation. Which is why our claims management sets us apart as a trusted, responsive and empathetic insurer that protects our clients worldwide. So what makes Chubb so effective in claims handling? For us it’s 3 things:

Our claims teams possess specialised knowledge, allowing us to fully grasp the challenges faced by Logistics clients and brokers.

Our expertise means we can swiftly understand the claim and respond appropriately. This expertise becomes particularly crucial where insurer decisions are required promptly.

As a global insurer, consistency is critical. Every claim receives a consistent response from any Chubb person, team, office or carefully selected partner, anywhere in the world, which is particularly important for Logistics clients with international operations or exposures.

This cohesive approach to claims assists in achieving swift resolutions, minimizing disruption to your business, and reducing associated costs.

Resources

Chubb Motor Fleet Insurance offers comprehensive coverage tailored for large fleet operators (of over 100 vehicles), helping you guard against risks like vehicle damage, accidents, and thirdparty liabilities.