Trauma Cover

Also referred to as Critical Illness insurance, Trauma Cover pays you a lump sum if you're diagnosed with a covered illness or condition for the first time.

Flexible options to suit your needs and budget

You have the choice to mix and match your cover level across one or both of our Trauma and Moderate Trauma Covers to suit your needs and budget. Continuous Trauma is also available on both covers.

Trauma Cover

Moderate Trauma Cover

Continuous Trauma Cover

Following a congenital heart disease diagnosis, contractor Phil Davenport had little choice but to book the surgery he’d been putting off for years, mainly due to the expense. Having not reviewed his insurance cover for many years, he didn’t realise the surgery, and other costs associated with his recovery could be paid for with the Chubb Life Trauma cover he’d had for several years.

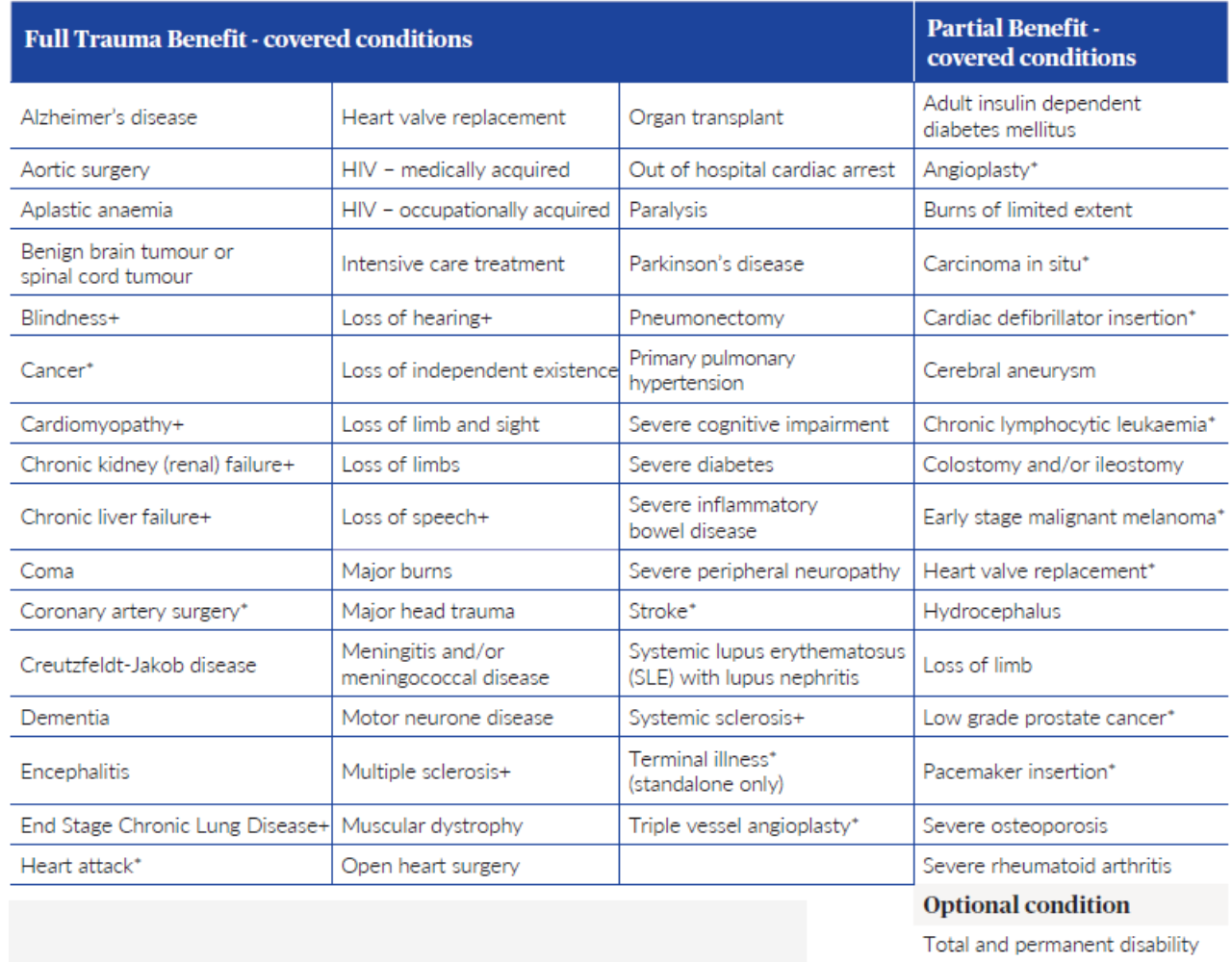

Trauma Cover provides you with comprehensive cover for a number of illnesses and conditions as outlined in the table below. To make a claim, you need to meet the relevant criteria of the condition. The full criteria can be found in the terms and conditions of the Trauma Cover.

A Full Trauma Benefit, Partial Benefit or Diagnosis Benefit may be payable depending on the criteria met for the condition.

* No claim is payable where you suffer from, are diagnosed with, or have signs or symptoms of, the condition within 90 days immediately after we get your application for this cover.

+ If the Diagnosis Benefit Criteria for this condition is met for the first time, an early partial payment may be made.

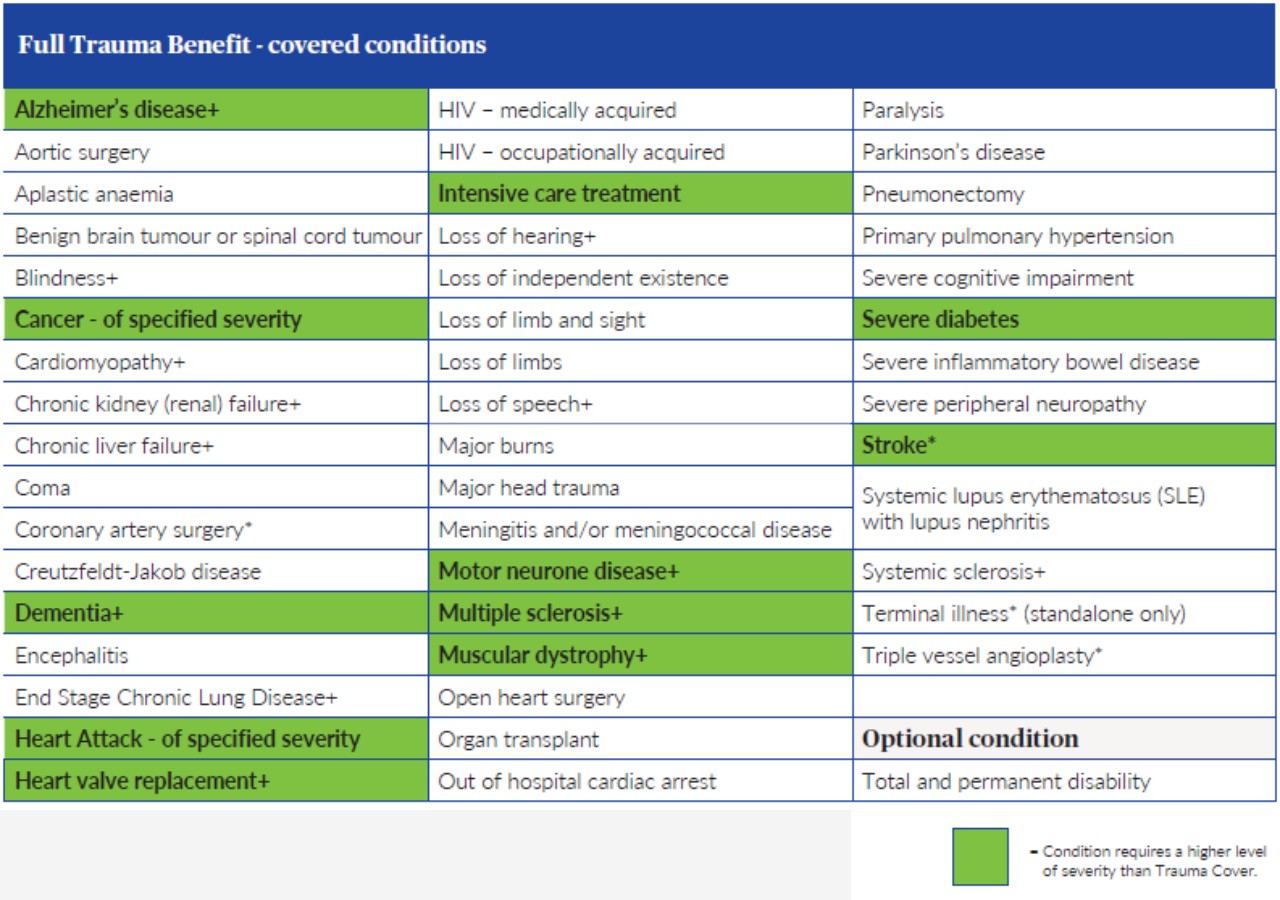

Moderate Trauma Cover provides you with cover for a number of illnesses and conditions as outlined in the table below. To make a claim, you need to meet the relevant criteria of the condition. The full criteria can be found in the terms and conditions of Moderate Trauma Cover.

Moderate Trauma Cover differs from Trauma Cover in that some, not all, covered condition definitions require a higher level of severity. These conditions are highlighted in the table below.

A Full Trauma Benefit or Diagnosis Benefit may be payable depending on the criteria met for the condition.

* No claim is payable where you suffer from, are diagnosed with, or have signs or symptoms of, the condition within 90 days immediately after we get your application for this cover.

+ If the Diagnosis Benefit Criteria for this condition is met for the first time, an early partial payment may be made.

You can have a maximum sum insured amount of up to $2,000,000 across both Trauma Cover and Moderate Trauma Cover.

Once your claim has been approved, you will receive a lump sum amount and it’s your choice how you use the money. Some examples of how this money can help are:

subsidise a lost income

cover day-to-day expenses (eg power, phone, food, petrol)

help cover debts eg mortgage, credit cards

assist with medical costs associated with recovery

seeking alternative treatments

paying for home alterations, rehabilitation and home help.

No. It includes a Full Trauma Benefit and Diagnosis Benefit.

Trauma Cover and Moderate Trauma Cover provide several benefits that are built-in to the cover as well as some options you can choose to add at an additional cost, so it’s easy to tailor your cover to suit your needs and budget.

Payment of the full Trauma Cover sum insured if you get a covered condition listed under our Full Trauma Benefit.

You can receive a partial payment of 25 percent of the Trauma Cover sum insured (up to $75,000), if you get a condition listed under our Partial Benefit.

An early payment of 25 percent of the Trauma Cover sum insured (up to $75,000), if you're diagnosed with one of the specific conditions

Complimentary Trauma Cover of up to $50,000 for your child (aged 3 months to 18 years inclusive).

Complimentary Cover of up to $50,000 for your newborn child.

Cover for costs of accommodation and transport for a support person to go with you if you need to travel away from your home area for treatment.

Cover for costs of up to $10,000 to get you back to New Zealand if you get a condition listed under our Full Trauma Benefit while living overseas.

A reimbursement of up to $2,500 for the costs of receiving professional advice.

Allows you to increase your sum insured by up to $250,000 if you experience a certain life event, without further assessment of your health

You can apply to convert an amount of the Trauma Cover for a life assured under this Trauma Cover to Moderate Trauma Cover on this policy, without requiring an assessment of the life assured’s health.

For everything you need to know about Trauma Cover, Moderate Trauma Cover and Continuous Trauma Cover options, download a copy of the relevant policy document.

Please refer to the policy wordings for our full requirements and eligibility criteria. The content is intended to be of a general nature, does not take into account your financial situation or goals, and is not a financial advice service. It is recommended you seek financial advice which takes into account your individual circumstances before you acquire a financial product. The information is current as at August 2022 and is subject to change.

If you’re still not sure, ask yourself:

If I was diagnosed with a serious illness or condition, would I have enough money to support my family while I receive treatment and recover?

If ‘no’, then now is a good time to talk to your Financial Adviser.

Your insurance is underwritten by Chubb Life Insurance New Zealand Limited (Chubb Life). Chubb Life has an A (Excellent) financial strength rating given by A.M. Best Company Inc. A summary of the rating scale is: A++, A+ Superior | A, A- Excellent | B++, B+ Good | B, B- Fair | C++, C+ Marginal | C, C- Weak | D Poor | E Under Regulatory Supervision | F In Liquidation | S Suspended. For the full rating scale and more rating information visit www.ambest.com/ratings/guide.pdf