Cyber Enterprise Risk Management

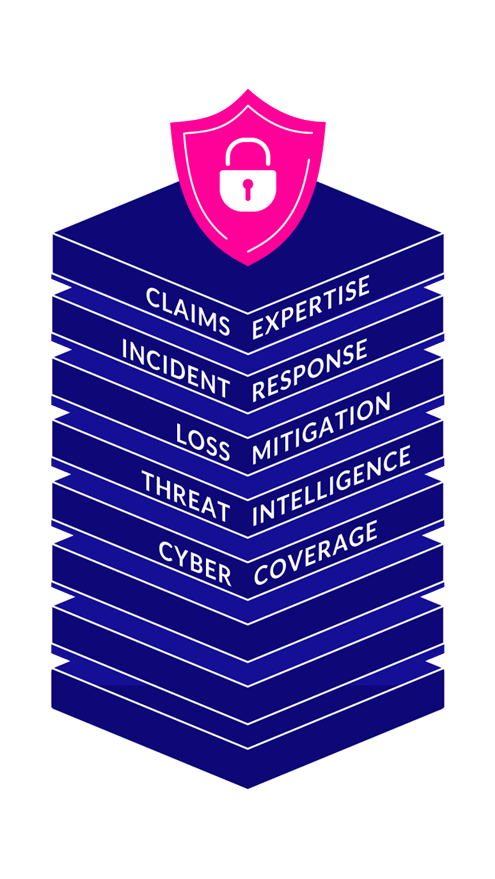

Stack up your cyber protection with Chubb

Cyber attacks, systems outages, and even employee mistakes can wreak havoc on your data security, your computerised processes, your business reputation - and your bottom line. To mitigate the potentially devastating damage of cyber exposures, Chubb offers a full suite of integrated insurance solutions that can be tailored to your business needs.

With our long history in cyber insurance, Chubb’s tailored products and resources — and our signature financial strength — will help stack up your defences in the ever-changing risk landscape of today’s digital world.

Who it’s for

- Financial institutions

- Healthcare

- Retail

- Hospitality

- Professional services

- Manufacturing

- Education

- Media and entertainment

- Technology

- Construction

What it covers

Chubb’s policy protects your company against all kinds of cyber risks and includes the following important benefits:

- Business interruption loss due to a network security failure or attack, human errors, or programming errors

- Data loss and restoration including decontamination and recovery

- Delay, disruption, and acceleration costs from a business interruption event

- Legal costs including exercising contractual indemnity

- Crisis communications and reputational mitigation expenses

- Liability arising from failure to maintain confidentiality of data

- Liability arising from unauthorised use of your network

- Network or data extortion/blackmail (where insurable)

- Online media liability

- Regulatory investigations expenses

Chubb Cyber Risk Management insurance product highlights:

- Measurement in the underwriting phase to help clients better assess cyber risks and position coverage more effectively

- Assistance through vendors to provide enhanced cyber risk management during the policy period

- Dedicated 24/7 incident response teams to assist in a crisis due to a covered cyber incident

- Our Cyber ERM insurance has simplified policy language and structure with end-to-end solutions.

More Chubb cyber proposition benefits to keep your company soundly covered

The right cyber stack can help mitigate exposures and reduce risk before an incident ever happens.

A disrupted network is just the beginning of the nightmare of a cyber

incident. Lost data, lost productivity, exposed customers, leaked

proprietary information - it's all at risk. So, we offer services that can

assist with incident response preparation, help you stay ahead of software

vulnerability exploits, improve your front-line defenses, and assist in

potentially preventing malicious activity from entering and spreading in

your network.

How to Report a Cyber Incident

When you suffer a cyber incident, the Chubb Incident Response Platform will act quickly to contain the threat and limit potential damage to your business.

Insurance you can trust

- We’re specialists in risk

We bring a wealth of experience together, because the biggest challenges need to be met by broad and deep expertise. - Coverage that enables growth

At the heart of our proposition is tailored coverage designed to grow with your needs and ambitions. All backed by specialist underwriting experts. - Proactive risk prevention

Our risk engineering capabilities can be deployed for larger, complex risks to help identify and mitigate risks before they impact your projects. - First-class claims management

Our expert claims handlers support clients through each stage of their claim. We’re quick to respond and act decisively. - Local insights

Local presence in 54 countries and territories, providing insights into leading edge of new technology developments.

-

Report

2025 H1 Cyber Threat Intelligence Report

-

Factsheet

Cyber Enterprise Risk Management (ERM) Factsheet

-

Report

Cyber Insurance for Small & Midsize Businesses

-

Factsheet

Cyber Insurance for the Healthcare Industry

-

Case Studies

Cyber Claims Scenarios

-

Proposal Form (Revenue Size Below US$100 million)

Cyber Enterprise Risk Management Short Proposal Form

-

Proposal Form (Revenue Size Above US$100 million)

Cyber Enterprise Risk Management Standard Proposal Form

Have a question or need more information?

Contact us to find out how we can help you get covered against potential risks