Side by Side Dementia Insurance Plan

Side by Side Dementia Insurance Plan

Overview

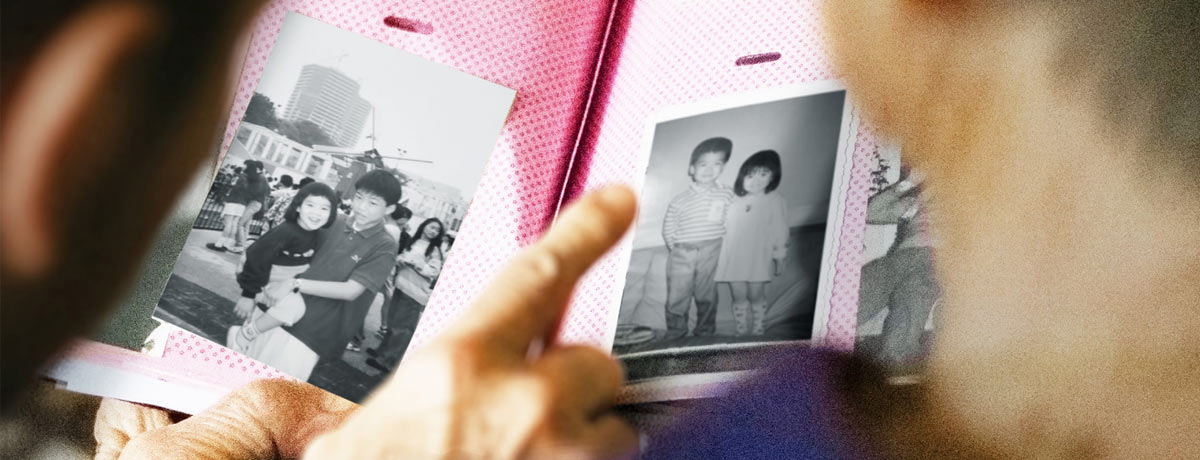

Dementia is more common than many realise, and its impact can be long lasting. Caring for someone with dementia is not a one-time challenge but rather a long journey that can stretch over many years. It affects not only the person diagnosed but the entire family. From making care decisions and adapting daily routines to managing rising long-term medical costs, the experience can quickly become overwhelming.

That’s why we introduced the Side by Side Dementia Insurance Plan (“Side by Side” or the “Plan”), the first-in-market basic plan solely focused on covering dementia condition. It’s more than just coverage – it’s a trusted partner that stands by your side throughout the whole journey, from early detection and diagnosis to long-term financial assistance, access to personalised value-added services and caregiver support.

Plan Highlights

The Plan offers benefits covering the initial diagnosis of both Moderate Dementia and Severe Dementia. With 3 plan levels available, you can choose the coverage that best suits your protection needs.

We offer flexible settlement options for the Severe Dementia Benefit. You can choose the payout method that works best for you to receive the Severe Dementia Benefit - whether it’s a one-time lump sum payment to address immediate financial needs, or monthly installment plan spread over time 5-year or 10-year for ongoing support.

Side by Side offers continued support beyond the initial diagnosis. Starting 1 year after the Severe Dementia Benefit is first paid, you will receive monthly payouts of 1% of the Sum Assured for 15 years or until the Insured passes away, whichever is earlier.

Side by side offers reimbursement for the Caregiver’s Counselling Expenses incurred after the Insured is diagnosed with Severe Dementia. It provides up to USD 125 per day for a maximum of 15 visits per Policy, ensuring the designated Caregiver receives the mental health support they need.

The Plan extends the valued-added service via Step by Step Care, a one-stop care support service that starts from the prevention stage across Hong Kong, Macau and designated GBA cities.

- Personal case management services

- Stay ahead with early cognitive assessment

- Daily living support

- Therapy services

- Extended training programmes

If no dementia claim is made during the Insured’s lifetime, the Plan will still provide the Death Benefit which is equivalent to 105% of Total Basic Premium Paid, to the Beneficiary if the Insured passes away.

By designating a Successor Owner, you can ensure proper management of the Policy. In the event of the Owner is Mentally Incapacitated, the Successor Owner will become the new Owner of the Policy upon the Company’s approval of the Successor Owner’s application.

If the Insured is diagnosed with Severe Dementia and the Severe Dementia Benefit will be payable, all future Premium payable (if any) under this Policy will be waived after the initial diagnosis of the Severe Dementia.

Applying for the Plan is quick and simple. Just answer one health question - no medical underwriting is required.

This webpage is for general reference only and should not be regarded as professional advice, recommendation and it is not part of the policy. It provides an overview of the key features of the product and should be read along with other materials which cover additional information about the product. Such materials include, but not limited to, product brochure that contains key product risks, policy provisions that contain exact terms and conditions, benefit illustrations (if any) and other policy documents and other relevant marketing materials, which are all available upon request. You might also consider seeking independent professional advice if needed.

The above information shall not be construed as an offer to sell, solicitation or persuasion to buy or provision of any of our products outside Hong Kong. For further information, please contact your Chubb Life Hong Kong Insurance Consultant or call our Customer Service Center Hotline at (852) 2894 9833.

The “Chubb Life Hong Kong”, “Company”, “we”, or “our” herein refers to Chubb Life Insurance Hong Kong Limited.