Protecting your home from water damage

Valuable insights into the surprise risks that could sink your home and finances.

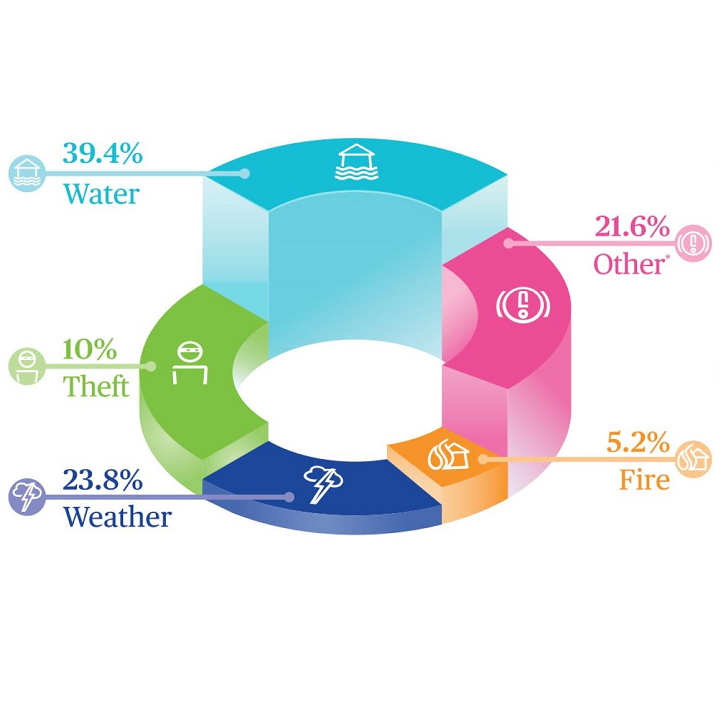

A review of Chubb's proprietary data reveals that water damage claims are now more costly than any other household incident, including fire and burglary. However, while most homeowners have locks, alarm systems and fire detectors installed, most are unaware of the threat of water damage and therefore largely unprepared for an incident.

Based on Chubb data for attritional claims averages from 2015-2019

* This includes a variety of claims for accidental damage or miscellaneous events.

"We've never filed a claim. So it was quite a shock when this actually happened."

Darrell B.

Protecting your home from water damage

Chubb Water Leaks Report

See how Chubb can help you get covered against potential risks.