A marine insurance product designed to simplify coverage by grouping cargo types based on their level and type of risk with internationally recognised Institute Clauses standard coverage.

OVERVIEW

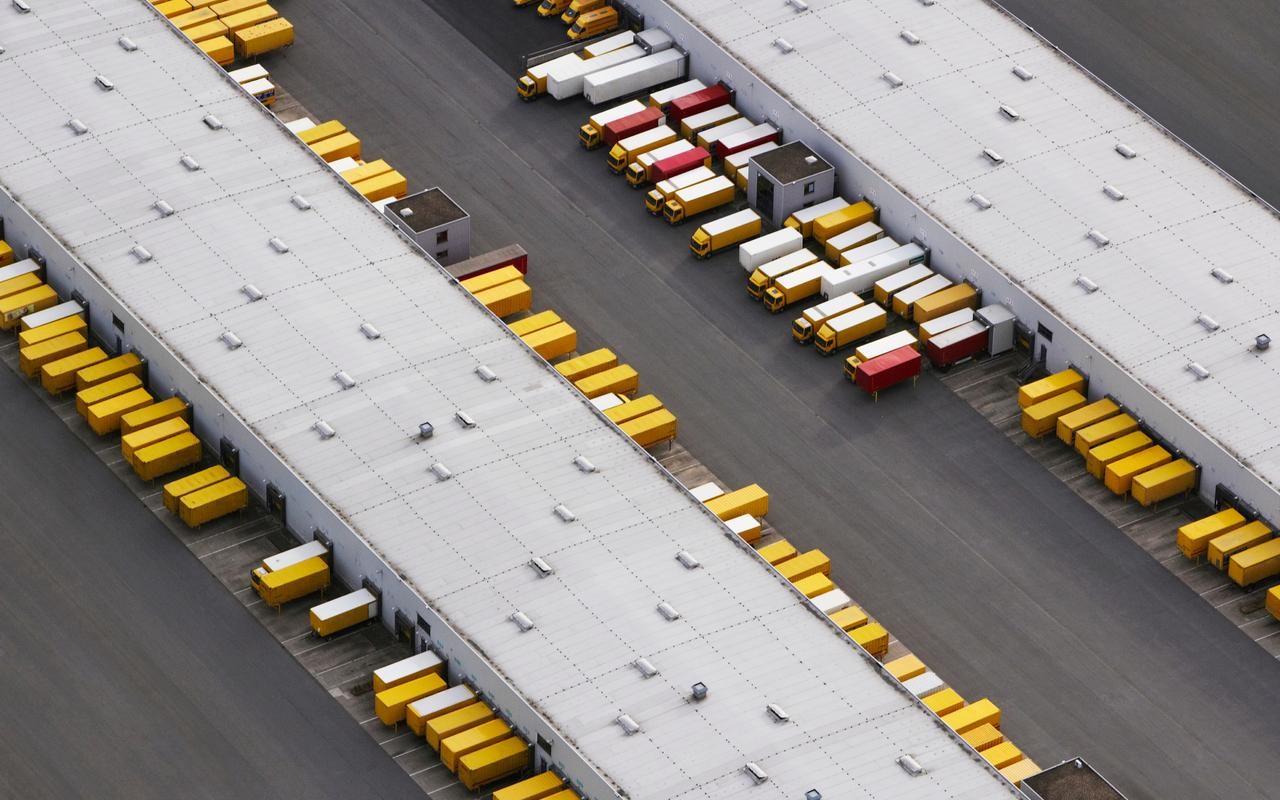

Chubb’s logistics insurance solutions are tailored to meet the protection needs of the freight and logistics industry.

We offer liability insurance solutions to transport operators of all sizes, from smaller freight forwarders to larger logistics companies, as well as last mile delivery and courier services.

Additionally, we offer single transit insurance for intermediaries in the logistics industry to integrate into the freight movement process.

LOGISTIC INSURANCE COVER

Who it's for

1. Freight Forwarders

2. Logistics Companies

3. Moving Service Companies

4. Road Transport Operators

5. Last Mile Delivery and Courier Services

What it covers

- Physical and/or accidental loss or damage to cargo during transit.

- Legal or contractual liability claims made against the business, providing financial security for transport operators’ daily operations.

- Legal liability arising from freight property damage, including both physical damage to the goods and financial loss experienced by the owner of the freight.

- Civil liability arising from a wrongful act in the performance of the transport operator’s services.

COVERAGE

COVERAGE

SERVICES

SERVICES

Contact us

Contact us

Have a question or need more information?

Contact us to find out how we can help you get covered against potential risks