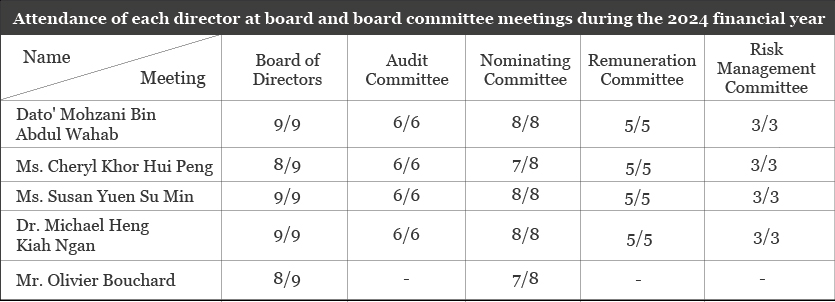

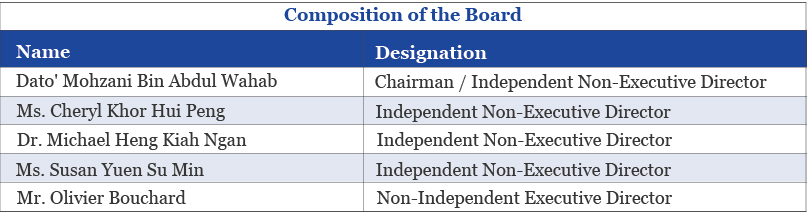

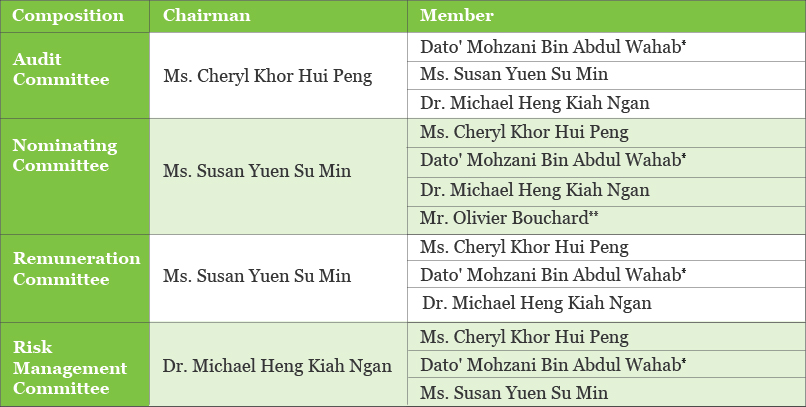

Board and Committee Composition

The Directors in office since the 2024 financial year are:

*Note: With effect from 29 August 2025, Dato' Mohzani Bin Abdul Wahab is no longer a member of the Board Audit Committee, the Nominating Committee, the Remuneration Committee and the Risk Management Committee.

**Note: With effect from 7 November 2025, Olivier Bouchard is no longer a member of the Board Nominating Committee.

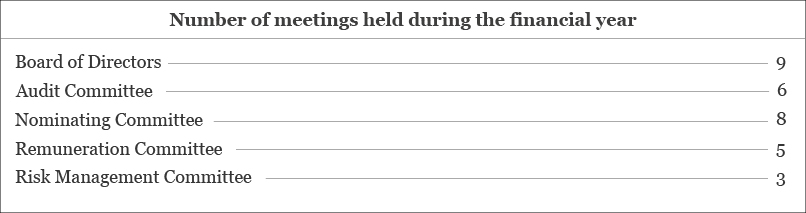

Number of Meetings Convened

The number of Board and Board Committee meetings held during the 2024 financial year is set out below:

Roles and Responsibilities

Board Responsibilities

The Board has the overall responsibility for promoting the growth and financial soundness of the Company, and for ensuring reasonable standards of fair dealing, without undue influence from any party. This includes a consideration of the long-term implications of the Board’s decisions on the Company and its customers, officers and the general public. In fulfilling this role, the Board must:

- Approve the Company’s strategy, risk appetite, business plans and other initiatives which would, singularly or cumulatively, have a material impact on the Company’s risk profile;

- Oversee the selection, performance, remuneration and succession plans of the Country President, control function heads and other members of senior management, such that the Board is satisfied with the collective competence of senior management to effectively lead the operations of the Company;

- Promote sound corporate values, governance frameworks and clear responsibilities;

- Oversee the implementation of the Company’s internal control framework, and periodically review whether these remain appropriate in light of material changes to the size, nature and complexity of the Company’s operations;

- Promote, together with senior management, a sound corporate culture within the Company which reinforces ethical, prudent and professional behaviour;

- Ensure the integrity of the Company’s financial and non-financial reporting, having consideration to whether disclosure is consistent with the Director’s own knowledge of the Company’s affairs;

- Promote sustainability through appropriate environmental, social and governance considerations in the Company’s business strategies;

- Oversee and approve the recovery and resolution as well as business continuity plans for the Company to restore its financial strength, and maintain or preserve critical operations and critical services when it comes under stress;

- Promote timely and effective communication between the Company and Bank Negara Malaysia (“BNM”) on matters affecting or that may affect the safety and soundness of the Company;

- Monitor how senior management carries out the Board’s strategy, and ensure responsible and ethical business practices;

- Ensure full compliance with applicable laws, regulations, and regulatory directives;

- Review and challenge senior management proposals and monitor their implementation;

- Determine the remuneration of independent directors, with affected individuals abstaining from decisions on their own remuneration;

- Oversee effective functioning of Board Committees, and define their authority and terms of reference;

- Oversee procedures to identify and manage conflicts of interest and related party transactions; and

- Ensure effective, transparent, and regular communication with stakeholders.

Audit Committee

The primary objective of the Board Audit Committee (“BAC”) is to assist the Board in meeting its responsibilities for the oversight of:

- The Company’s accounting and financial reporting process and practices;

- The Company’s system of risk management and internal controls;

- The Company’s internal and external audit process; and

- Conflict of interest situations and related party transactions involving the Company.

Nominating Committee

The primary objective of the Board Nominating Committee (“BNC”) is to assist the Board in relation to:

- Proposing new nominees for the Board and senior officers of the Company;

- Reviewing and assessing the effectiveness of Directors and senior officers of the Company on an ongoing basis;

- Assessing the size and composition of the Board;

- Ensuring the criteria to conduct periodic evaluation for effectiveness of the Board and Board Committees are based on robust processes and procedures, taking into consideration the needs of the Board such as mix of skills, independence, experience and industry knowledge.

Remuneration Committee

The primary objective of the Board Remuneration Committee (“BRC”) is to assist the Board in meeting its responsibilities in relation to remuneration packages recommended for Directors and senior officers, developing a remuneration policy for Directors and senior officers, and ensuring that compensation for Directors and senior officers are competitive and consistentwith the Company’s culture, objectives, and strategy.

Risk Management Committee

The primary objective of the Board Risk Management Committee (“BRMC”) is to assist the Board in meeting its responsibilities for:

- Identifying, assessing and monitoring key business risks;

- Reviewing and recommending risk management policies and strategies of the Company for the Board’s approval;

- Ensuring senior management maintain a sound system of strong internal controls and risk management processes; and

- Promoting a zero-tolerance approach to bribery and corruption through leadership, commitment, and setting out standards of behaviour expected from all Directors and employees.

Attendance